IRS Form W-2 is an essential document that serves as a wage and tax statement, which employers must provide to their employees by the end of January each year. This form details an employee's annual earnings along with the amount of taxes withheld from their paycheck, information crucial for filing accurate tax returns. Its meticulous breakdown includes federal and state taxes, social security, and Medicare earnings, among other pertinent data. As the fiscal year rolls out, employees nationwide anticipate the W2 tax form for 2023 to reconcile their fiscal obligations precisely.

Delving into tax preparation can be daunting, but our website, w2form2023.us, emerges as a beacon of clarity, guiding taxpayers through the intricacies of the blank W2 form printable for 2023 and its features. With a trove of materials at one's disposal, including comprehensive instructions and illustrative examples, the path to understanding and completing the document becomes significantly less forbidding. Our website is a valuable resource for everyone needing the W2 form for 2023 in PDF for download and for those requiring assistance with the filling process.

Tax Form W-2 Filing Rules and Exemptions

If you're an employer engaged in business, it is essential to prepare an IRS Form W-2, Wage and Tax Statement, for each individual who served as your employee during the fiscal year. This crucial document details the compensation and tax withheld for your workforce and ensures compliance with federal regulations. Access to the 2023 W2 form in PDF format is available on our website.

Individuals and entities that may not be required to file this form include:

- Employers facilitating payment to independent contractors.

- Businesses that paid less than $600 to employees throughout the tax year.

- Employers conducting business in select tax-exempt sectors.

- Employees categorized under certain religious exemptions.

- Payroll adjustments processed within the same tax year, negating the need for forms.

Steps to Fill Out the W2 Blank Form for 2023

The process has been streamlined on our platform to ensure swift and accurate filing, keeping in line with the IRS stipulations and deadlines. You may choose to download the blank template or opt to fill out the W-2 form online, simplifying the process and saving time.

- To accurately complete your W-2 form for 2023 for free, begin by navigating to our website and downloading the latest blank W2 template.

- Next, gather all your employment and income documentation to ensure the data you enter is accurate.

- Start filling out the form by entering your personal information, including your Social Security Number and address.

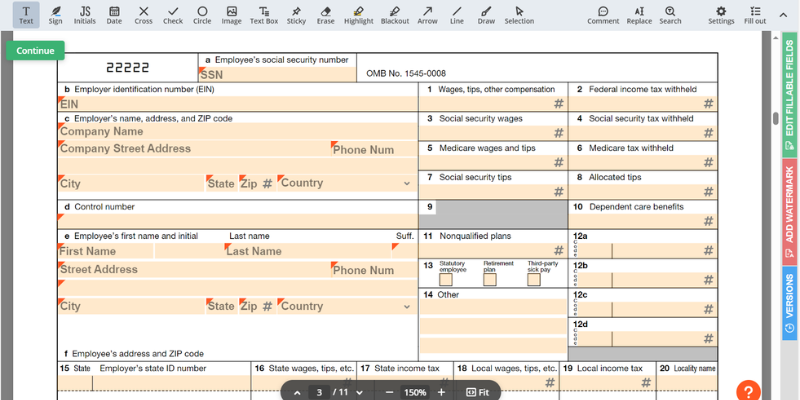

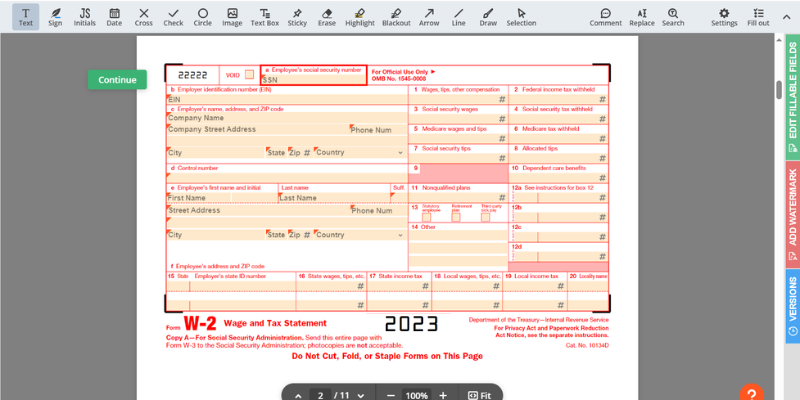

- Moving on, input your employer's details as specified in Sections A-F:

- Employee's Social Security Number (SSN)

This box contains the employee's SSN, which is used to identify the employee's tax records with the Social Security Administration and the IRS. - Employer Identification Number (EIN)

This is the unique number assigned to the employer by the IRS for tax identification purposes. - Employer's Name, Address, and ZIP Code

Here, you will find the employer's legal name, address, and ZIP code. Depending on the business's structure, this address might be the location of the company headquarters or a specific branch. - Control Number

This is a code that the employer may use to identify the W-2 form in their record-keeping system. Not all employers use a control number, so this box might be blank. - Employee's Name

This section includes the full name of the employee as it appears on their Social Security card. It is important for this information to match Social Security Administration records for accurate tax reporting. - Employee's Address and ZIP Code

The employee's home address and ZIP code are listed here. This is the address where the W-2 form is mailed, and it should be where the employee lived when the document was issued.

- Employee's Social Security Number (SSN)

- Ensure correct figures are entered in boxes 1-20, reflecting wages and taxes withheld. Use a sample of the W2 form filled out for guidance on entering deductions and contributions.

- Before finalizing, double-check all entries for mistakes. Once completed, use our online system to file directly or print and mail your W-2.

File the W-2 Copy to the IRS on Time

As the calendar flips to a new year, employers must gear up for tax season, tackling obligations such as the IRS Form W-2 for 2023. Traditionally, the deadline to file W-2 forms is January 31st, following the tax year's end. This due date ensures that employees receive their tax information in time to prepare their individual returns by mid-April. Accuracy in reporting and timeliness is crucial, as the W-2 provides vital income and withholding details for employees.

Time Extension for Federal W-2 Form

While it's important to adhere to this deadline, there may be circumstances where an extension is necessary. Employers needing additional time can request a one-time extension by submitting Form 8809 to the IRS before the due date. However, it's worth noting that this extension applies to filing with the SSA, and employees should still receive their W-2s by January 31st. For those preparing to tackle this task, accessing a printable W2 form for 2023 can simplify the process, offering a fillable template to ensure all necessary information is accurately captured and submitted on time.

Free Fillable W-2 Form in PDF

Free Fillable W-2 Form in PDF

W-2 Form Instructions

W-2 Form Instructions

Federal Form W-2

Federal Form W-2

Fillable W2 Form for 2023

Fillable W2 Form for 2023

Printable W2 Tax Form

Printable W2 Tax Form