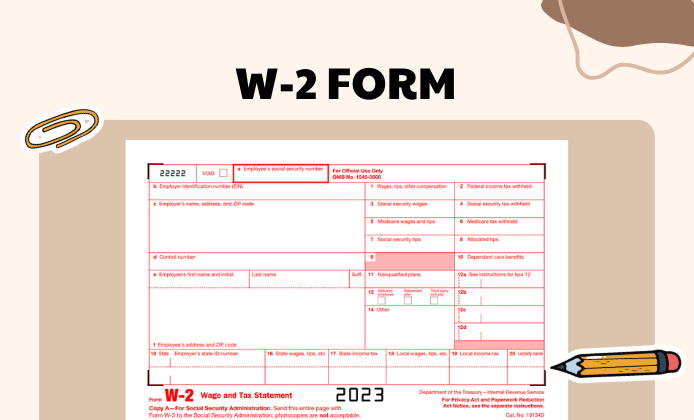

When tax season rolls around, employers have the important job of providing a W-2 form to each of their employees. The IRS printable W2 form is a cornerstone document that reports an employee's annual wages and the amount of taxes withheld from their paychecks. Comprehending the structure of this critical form is essential for both employers preparing it and employees reviewing it for accuracy. The W-2 is broken down into several boxes, each with specific data: from basic personal and employer information to detailed financial figures concerning income, social security wages, Medicare wages, and tax withholdings. Each box on the form plays a vital role in painting a clear picture of an individual's taxable income.

Completing the W2 Tax Form: Step-by-Step Instructions

Before distributing the printable W2 tax form, it's vital that employers fill in every detail accurately to prevent any discrepancies that could affect an employee's tax filings. Here are some key pointers to pay attention to:

- Ensure every employee's personal information, such as their full name and Social Security number, is entered correctly.

- Double-check that your employer identification number (EIN) and your business's name and address are filled in.

- Report each employee's annual wages and the respective federal, state, and other taxes withheld in the respective boxes.

- Verify the amounts reported for Social Security and Medicare taxes for accuracy.

- Avoid common errors like mixing state and federal taxes or misreporting taxable income.

Steps to File the W2 Printable Form

Once the printable IRS Form W2 has been accurately prepared, submitting it properly is the next crucial step. Here’s what to do:

- Gather all completed W-2 forms and organize them alphabetically by employee last name to facilitate the process.

- Remember to make copies for your records and for distribution to employees.

- Distribute the employee copies, ensuring they each receive a Form W-2 in either electronic or paper format. If paper, it must be provided in a manner that protects their privacy and is compliant with IRS regulations.

- File Copy A of the W-2 and Form W-3 to the Social Security Administration, which can be done electronically or through mail.

- Submit state copies if your state has income tax requirements according to your specific state’s submission guidelines.

Timeline for IRS Form W2 Submission

An important detail to remember is the deadline for these forms. Employers are required to send out the printable W2 form for free to their employees by January 31. This is also the deadline for electronic or mail submissions of Copy A to the Social Security Administration. For the 2023 tax year, this means that all forms must be prepared and distributed by January 31, 2024. Delays can lead to penalties, so it's crucial to have your documents ready well in advance. Taking these deadlines seriously is paramount for employers' compliance with tax laws.

For those needing access to the W2 printable form for 2023, the IRS provides these documents free of charge, which can be downloaded from their official website. By following the diligent steps above—one can ensure that the forms maintain their integrity from preparation to submission, safeguarding against any potential tax season snafus.

Fillable W2 Form for 2023

Fillable W2 Form for 2023

Printable W2 Tax Form

Printable W2 Tax Form